The numbers don’t lie, fraud is exploding across every industry, and traditional fraud detection methods are failing to keep up. It’s time for a fundamental shift in how we protect our businesses.

TL;DR: Why Upstream Fraud Prevention Matters

- Fraud is getting harder to stop: Losses are rising fast, fueled by deepfakes and synthetic documents. Once fraud gets into your system, it’s almost impossible to recover the money.

- Catching it earlier changes everything: By validating documents the moment they’re submitted, you stop bad data before it ever reaches your workflows.

- That’s what we built at Veryfi: Our engine combines device checks, computer vision, and data validation in one place, so fraud gets blocked in real time, without slowing down customers.

The Fraud Epidemic: A Crisis Across Industries

Let me start with some statistics that should keep every business leader awake at night. Consumers reported losing more than $12.5 billion to fraud in 2024, which represents a 25% increase over the prior year, according to the Federal Trade Commission (FTC, 2025). But that’s just the tip of the iceberg.

The FBI’s Internet Crime Complaint Center reported losses exceeding $16 billion in 2024, representing a 33% increase from 2023 (FBI, 2025). Even more alarming, industry analysts predict GenAI could enable fraud losses to reach $40 billion in the US by 2027, up from $12.3 billion in 2023 (Deloitte, 2024).

The Industry Breakdown: No Sector is Safe

Financial Services and Banking: Banking and financial services organizations reported 305 cases of fraud with a median loss of $120,000 per incident, according to the Association of Certified Fraud Examiners’ 2024 Report to the Nations (ACFE, 2024). The total losses calculated in the latest ACFE report reached $3.1 billion across all analyzed fraud cases, demonstrating the massive scale of occupational fraud affecting the financial sector.

Healthcare and Insurance: Healthcare fraud represents one of the most devastating categories. Conservative estimates place healthcare fraud at 3% of total healthcare expenditures, while some government and law enforcement agencies estimate losses as high as 10%, potentially exceeding $300 billion annually (NHCAA, 2024). With the United States spending over $2.27 trillion on healthcare annually, the NHCAA estimates that tens of billions of dollars are lost to healthcare fraud, directly impacting patients, taxpayers, and government through higher costs.

The insurance sector faces immense challenges across all lines of coverage. Fraud conservatively steals $80 billion per year across all lines of insurance, comprising about 10 percent of property-casualty insurance losses and loss adjustment expenses annually. More recent estimates suggest the problem has grown even larger, with total losses due to insurance fraud across the country reaching $308 billion, a dramatic increase from earlier estimates.

Investment and Securities: Investment scams accounted for the most fraud losses at $5.7 billion, highlighting how fraudsters are increasingly targeting financial markets and investment platforms (FTC, 2025).

The Recovery Reality Check

Here’s the brutal truth that every executive needs to understand: 54% of organizations never recover fraud losses. When fraud slips through your defenses, the chances of recovering those funds are slim to none. This isn’t just a financial problem, it’s an existential threat to business sustainability.

The Problem with Traditional Fraud Detection

Most fraud detection systems are fundamentally reactive. They’re like a security guard who only shows up after the robbery. They analyze transactions after processing, flag suspicious patterns in hindsight, and leave you scrambling to recover losses that, statistically speaking, you’ll never see again.

The traditional approach follows this flawed sequence:

- Accept and process the transaction

- Detect suspicious patterns later

- Flag the fraud after damage is done

- Attempt recovery (which fails 54% of the time)

- Write off the losses

This model was barely adequate when fraud was simpler and less sophisticated. Today, with AI-powered attacks and increasingly complex fraud schemes, it’s completely inadequate.

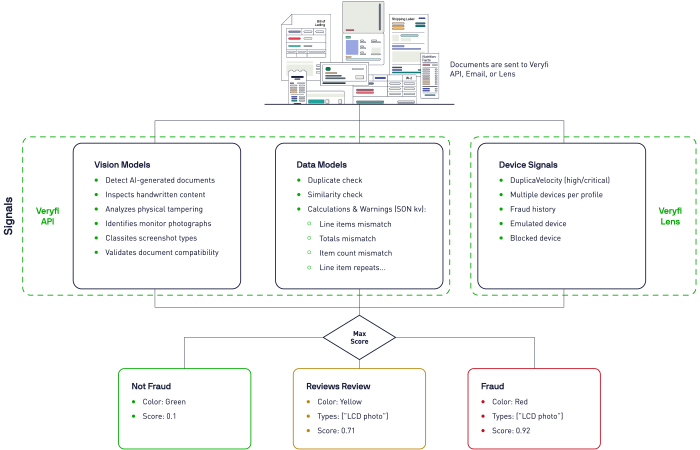

A Revolutionary Two-Tier Approach: UpStream Prevention

What makes Veryfi’s UpStream Fraud Prevention Engine different is its proactive approach. Instead of waiting for fraud to happen and then trying to detect it, we stop it before it ever enters your system. This isn’t just a technological improvement, it’s a complete paradigm shift.

Our proprietary Two-Tier system combines the power of edge computing with cloud-based AI to create multiple layers of protection:

Tier 1: Veryfi Lens Mobile Capture Framework The first line of defense happens right on the user’s device. Our Veryfi Lens framework runs sophisticated machine learning models locally, performing initial device and image quality checks before any data ever reaches your servers. This means we’re catching fraudulent attempts at the point of capture, not after processing.

Tier 2: Cloud-Based AI Processing Documents that pass the initial screening are then analyzed by our Day-1 Ready AI-Powered processing APIs in the cloud. This second tier applies advanced computer vision, natural language processing, and behavioral pattern recognition to detect even the most sophisticated fraud attempts.

Deep Dive: Two Critical Fraud Signals

Let me walk you through two specific fraud detection capabilities that demonstrate the power of our upstream approach:

High Velocity Detection

High velocity fraud is one of the most common attack patterns we see. Fraudsters often use automated systems to submit multiple fraudulent documents rapidly, hoping to overwhelm detection systems or exploit processing delays.

Our system monitors submission patterns across multiple time intervals:

- Last 6 minutes: Catches immediate burst attacks

- Last day: Identifies sustained attack patterns

- Last 2 weeks: Detects medium-term campaign strategies

- Last 30 days: Uncovers long-term systematic fraud attempts

When we detect high velocity patterns from a specific device_id, the system immediately flags these submissions with a yellow warning. The thresholds are fully configurable, allowing you to adapt to your specific business requirements and risk tolerance.

Digital Tampering Detection

This is where our computer vision technology really shines. Digital tampering has become increasingly sophisticated, with fraudsters using advanced photo editing software to modify documents. Our system can visually detect cases where fraudsters have:

- Used software like Photoshop to digitally change numbers, text, or QR codes in documents

- Copied and pasted parts of the same photo (for example, changing a total amount from $99 to $9999)

- Altered specific fields while leaving the rest of the document intact

What sets our digital tampering detection apart is its granularity. We don’t just flag a document as “potentially tampered”, we identify exactly which fields have been modified. In our JSON response, you’ll see specific field identifications like “total,” “line_items.10.total,” and “line_items.14.total,” giving you precise insight into what has been altered.

How it works:

Catching AI-Generated Documents: The New Frontier

The rise of generative AI has created an entirely new category of fraud risk. Sophisticated AI platforms like ChatGPT, Stable Diffusion, MidJourney, GANs, and DALL-E can now create remarkably realistic-looking documents that never existed in the physical world.

Most fraud detection systems are unprepared for this threat. They rely on basic metadata analysis that can be easily bypassed by anyone with modest technical knowledge. Our approach is fundamentally different.

Our proprietary machine learning model performs deep structural analysis of document content. We’re not just looking at metadata, we’re analyzing the fundamental structure, patterns, and characteristics that distinguish authentic documents from AI-generated ones. This comprehensive approach ensures reliable detection of even the most sophisticated AI-generated forgeries.

The speed of detection is crucial here. While competitors might take minutes or even hours to analyze documents, our system provides lightning-fast detection, giving you near-instantaneous confidence in document authenticity.

The UpStream Advantage: Prevention Over Reaction

The fundamental difference between our UpStream approach and traditional fraud detection is timing and effectiveness. Instead of the traditional reactive sequence of process-detect-flag-recover, we flip the script:

- Capture-time validation via Veryfi Lens on-device

- Pre-processing fraud screening in the cloud

- Real-time decision making before any financial exposure

- Immediate fraud prevention with zero losses

This approach eliminates the recovery problem entirely because there’s nothing to recover, fraudulent documents never make it into your system.

Why This Matters Now More Than Ever

The fraud landscape is evolving rapidly. Traditional static rules and simple pattern matching are no longer sufficient. Modern fraudsters are using AI tools, sophisticated image editing software, and coordinated attack campaigns. They’re creating synthetic identities, generating fake documents with AI, and exploiting the gaps in reactive fraud detection systems.

The cost of being reactive in this environment isn’t just financial, it’s reputational and operational. Every fraud incident that slips through requires investigation resources, customer communication, potential legal exposure, and damage to your brand trust.

With 54% of organizations never recovering fraud losses, the math is simple: prevention isn’t just better than detection, it’s essential for survival.

The Future of Fraud Prevention

The days of playing defense against fraud are over. In an environment where AI-generated documents can be created in minutes and sophisticated tampering can be done by anyone with basic software skills, reactive fraud detection is a losing strategy.

Veryfi’s Two-Tier UpStream Fraud Prevention Engine represents the next evolution in fraud protection. By combining edge computing, advanced AI, and real-time analysis, we’re not just detecting fraud, we’re preventing it entirely.

The statistics are clear: fraud is exploding across every industry, losses are mounting, and recovery rates are dismal. The question isn’t whether you can afford to implement upstream fraud prevention, it’s whether you can afford not to.

Don’t wait for fraud to hit your organization. Stop it before it starts.

Ready to protect your organization with upstream fraud prevention?

Learn more at veryfi.com/fraud-detection or contact our team at [email protected] to see how we can help you stop fraud before it costs you.