Fraud detection that automates loss prevention

Beyond never using humans-in-the-loop to read documents, Fraud Intelligence creates a formidable defense against complex Fintech and CPG scams.

Get Started for Free Free Demo

Trusted by companies from seed → scale

Don’t Be a Fraud Statistic

-

39%

fraudulent documents are circulating

-

55%

are manually and digitally altered documents

-

$117K to $1.7B LOSS

Fraud costs companies of all sizes anywhere from $117K to $1.7B of losses in revenue, profits, and permanently denigrated security and public image.

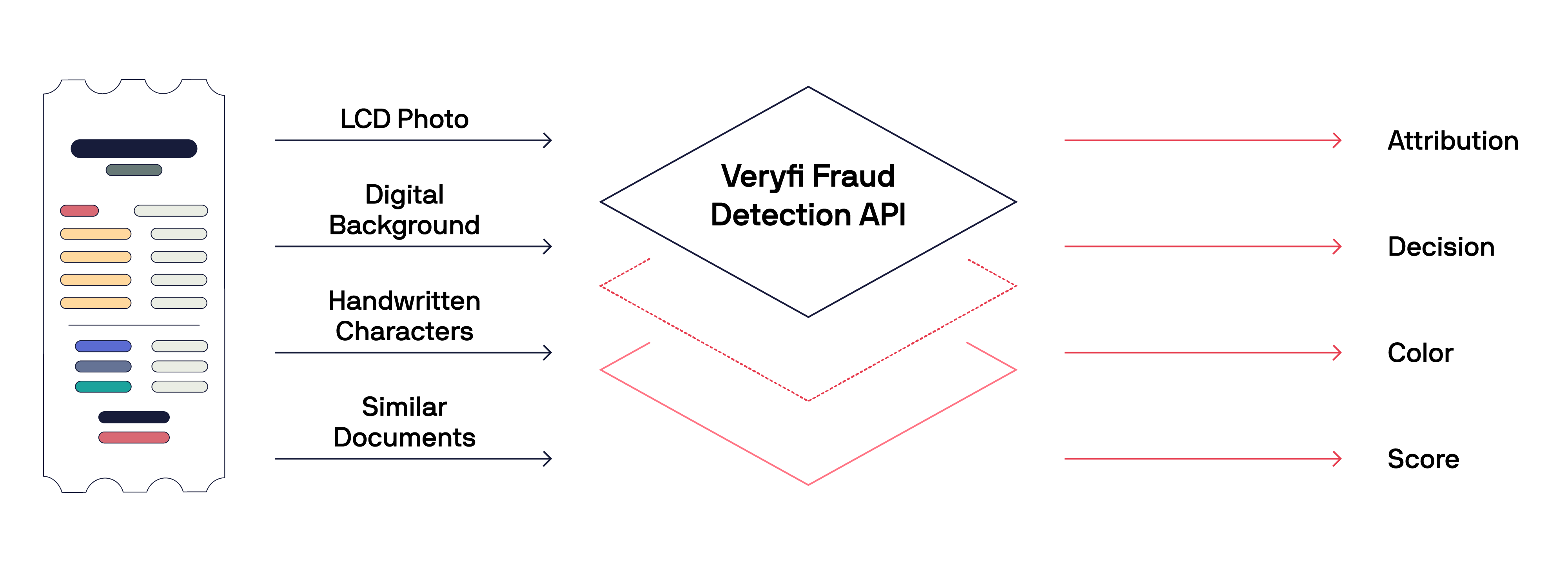

How Veryfi Fraud Intelligence Works

Veryfi Fraud Intelligence plays a pivotal role in shaping OCR technology that’s capable and proactive. Working with Veryfi OCR API, this synergy between intelligent document processing and fraud intelligence creates an indispensable approach to catch the most creative fraud. The system works in a multi-stage process. Initially, the OCR component scans and extracts text and data from documents with exceptional accuracy. AI algorithms then meticulously analyzes the structured data, scrutinizing every detail from transaction amounts to dates to vendor identification numbers and customer names. The system cross-references this information with historical data to identify anomalies and inconsistencies. These anomalies could range from unauthorized transactions and manipulated figures to suspicious alterations in document details.

By continuously learning and adapting, the AI component of Veryfi OCR API becomes increasingly adept at recognizing even the most sophisticated fraudulent attempts. The benefits of this integrated approach are manifold. Firstly, fraud detection significantly minimizes financial losses by identifying and preventing fraudulent transactions in real-time. Secondly, it enhances compliance by ensuring that financial records are fully adhering to regulatory standards. It then reduces operational efforts by automating fraud detection, saving time that would otherwise be spent on manual checks. Ultimately, the combination of OCR and fraud detection not only makes financial document processing intelligent but also fortifies it against the ever-evolving tactics of creative criminals, ensuring greater security and peace of mind for users. Below, see how Veryfi Fraud Intelligence detects both fraudulent and out-of-policy aspects on a receipt:

Veryfi Fraud Intelligence issues a range of warnings and attributions to stop fraud right in its tracks.

-

Document Velocity

Fraud Intelligence detects any high or abnormal amount of submissions from a specific device across timeframes. High velocity from a specific device indicates fraud almost 100% of the time.

-

Manipulated Handwriting

Fraud Intelligence detects handwriting in specific fields in the submitted document. OCR with AI is able to discern when fields are being fabricated in receipts, bank checks, statements, and any kind of document.

-

Manipulated Photos

Fraud Intelligence detects submitted fake documents that are photos of LCD monitors and screens. Using AI, the API flags the submitted image as NOT a document and stops document processing.

-

Duplicate Document

Using algorithms detecting image similarity and text, Fraud Intelligence detects dupes of a previously submitted one. It also mitigates current and future risks from each distinct case of fraud using meta.is_duplicate field.

Watch demo: capture and extract with fraud detection

Match made in heaven: Fraud Intelligence + ∀Docs

∀Docs extracts every imaginable document. Check it out.

Discover More

Customers are leveraging Fraud Intelligence.

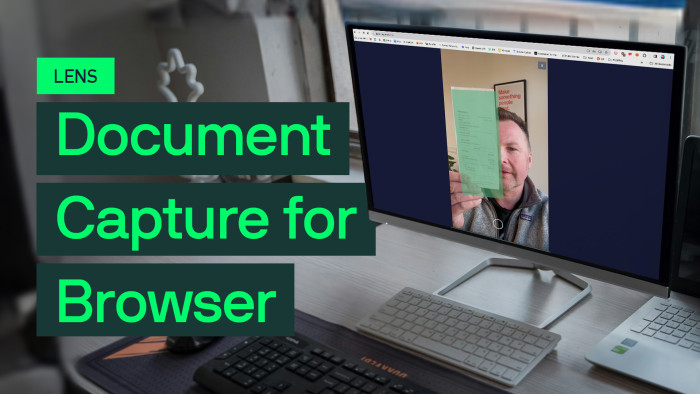

At the moment of document capture using Veryfi Lens, Fraud Detection–using real-time signals checkers–bounces faulty documents and stop them from getting extractions and stops you from getting charged. Embedded into Veryfi OCR API, Fraud Detection flags fraudulent fields to stop theft of time and resources in their tracks.

![SDK Escáner de Documentos para Android [Código con Alejo] #spanish](https://cdn.veryfi.com/wp-content/uploads/code-with-alejo-700x394.jpg)

![Mobile Android Document Scanner SDK [Code with Andy]](https://cdn.veryfi.com/wp-content/uploads/code-with-andrew-9-700x394.jpg)