Let’s say your team members each have a company credit card for company expenses and you want to make sure they’re all legitimate. Here’s how the process looks in Veryfi:

- Expenses are recorded in the credit card’s transaction history

- Receipts for these expenses are collected by the team member

- Periodically (e.g. daily, weekly, monthly), the team member matches their transactions against their supporting documents/receipts

- The manager or admin responsible for the team member reviews and approves these transactions

Explainer video

Step by Step Instructions

Following is a guide on how we achieve this in Veryfi.

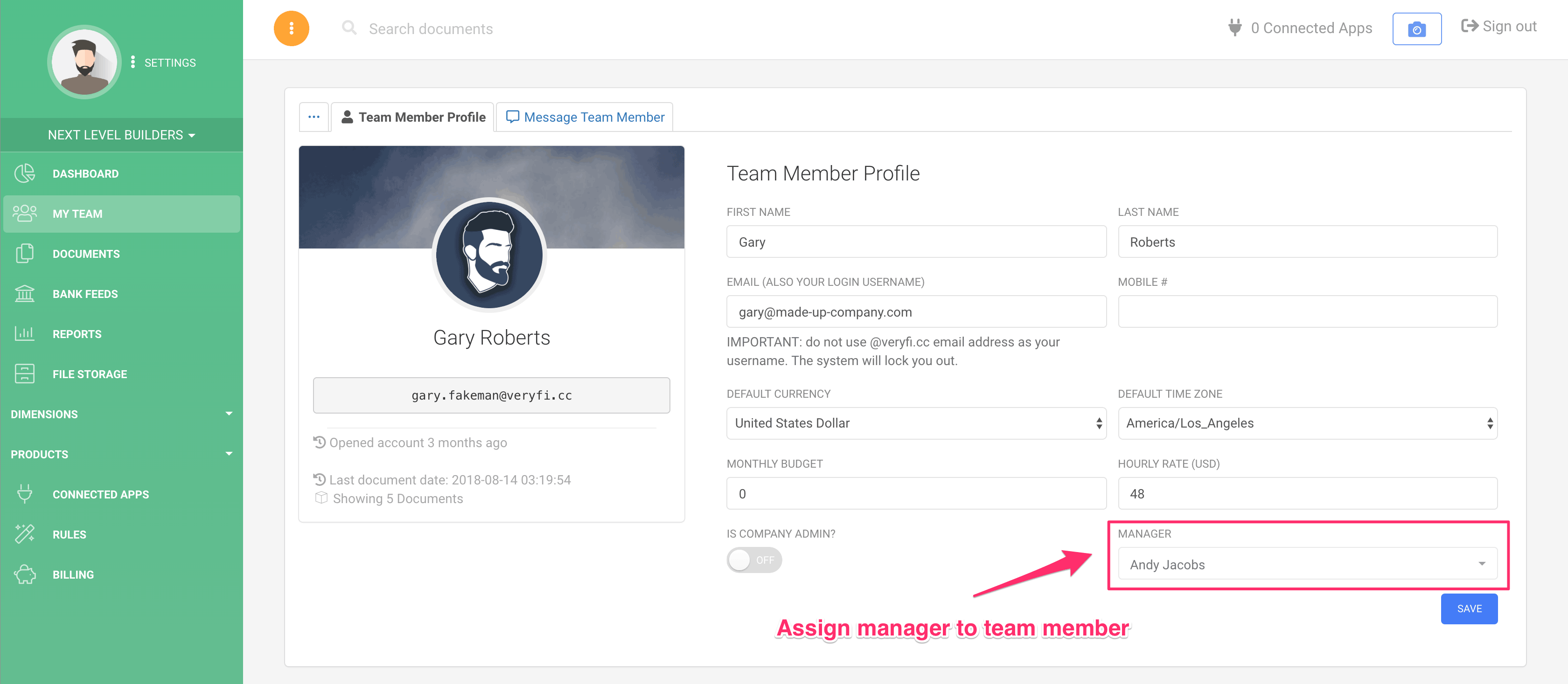

1. Assign team managers (optional)

If your company has management responsible for approving their reportees’ expenses, they will need to have access to both the documents and the bank/credit card transactions for their reportees. This can be done without assigning full admin rights to managers by setting up the appropriate manager-reportee relationships.

- Go to My Team.

- Click the name of the team member that will have a manager assigned to them.

- Select the manager to assign to this team member.

- Click Save.

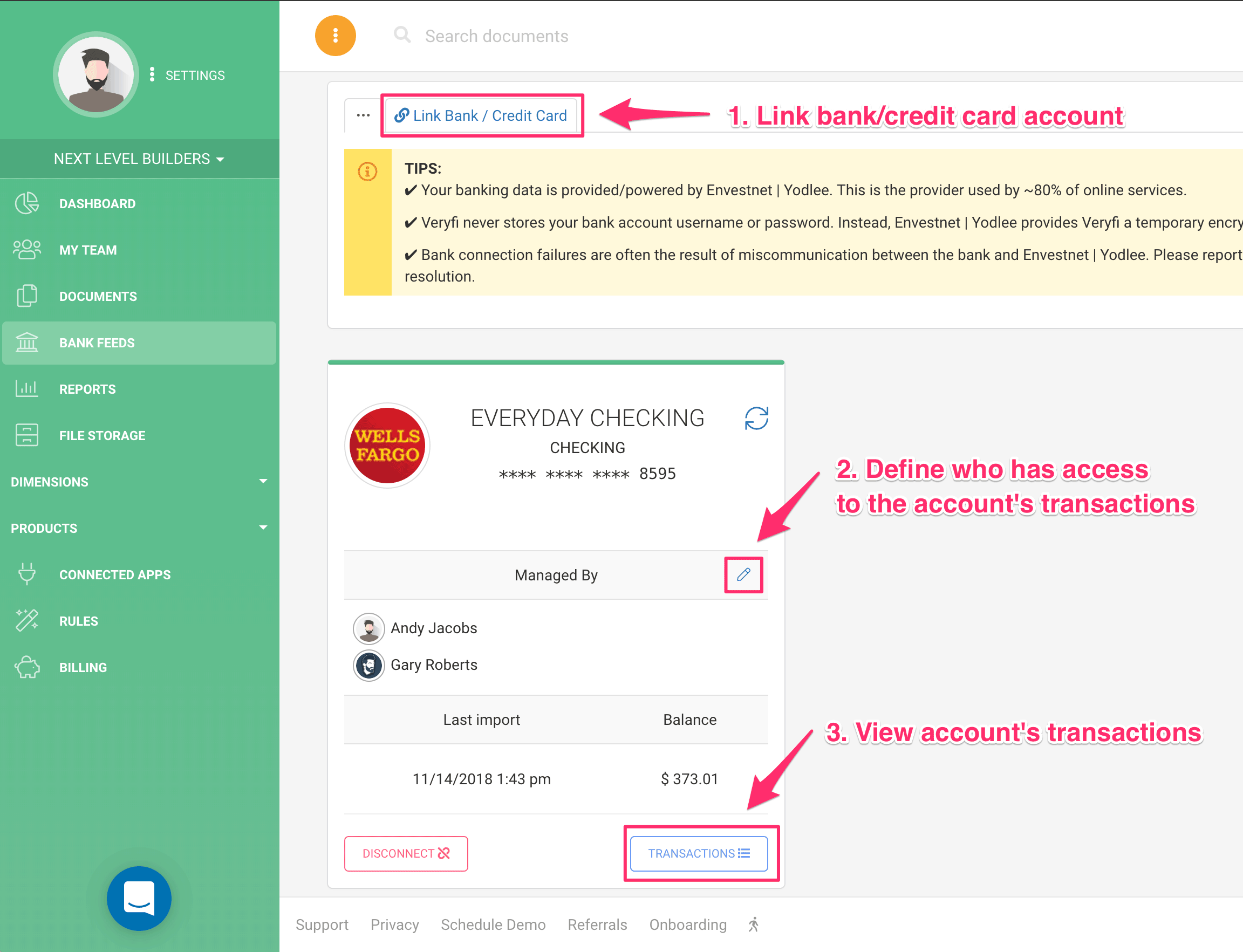

2. Link credit card accounts

Each team member’s credit card account will need to be linked either by an admin, or by the team member themselves.

Once linked, make sure that the appropriate team members have access to manage each account. This will need to include both the card holder and the person or people responsible for approving transactions.

NOTE: An approver must be either an admin, or the team member’s manager.

3. Reconcile transactions with their supporting documents

If you’re not already familiar with how to reconcile transactions in Veryfi, read this article first to get familiar with it: https://www.veryfi.com/howto/bank-reconciliation/

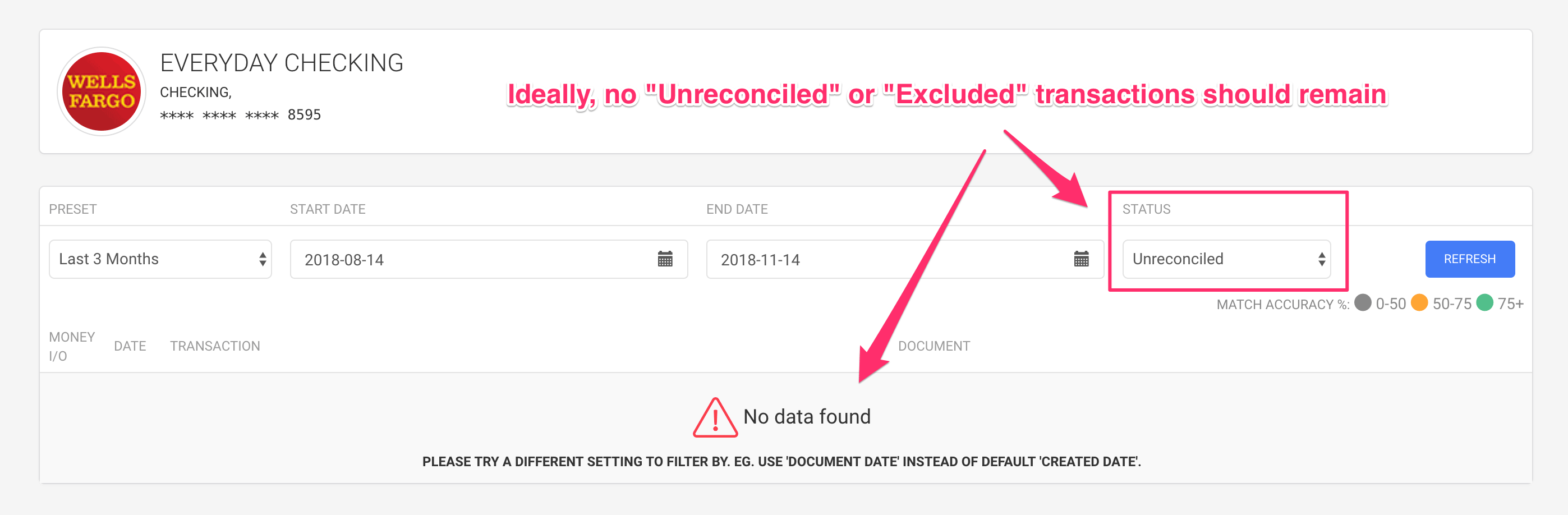

Each company card holder will need to reconcile their credit card transactions against the supporting documents. The idea here is that once this process has been done (e.g. at the end of each week or month, etc), there should be no “Unreconciled” transactions remaining, because all transactions would be reconciled with their supporting documents. Ideally, there would also be no “Excluded” transactions either, unless there are valid reasons to not have supporting documents for those transactions. Once the banking reconciliation process is done, the card holder’s job for the period is done.

4. Review and approve expenses

The final step in the process is completed by an admin or the card holder’s manager.

- As a manager or admin, open the transactions list of a card holder’s linked account.

- Review the “Unreconciled” and “Excluded” transactions for the appropriate date range to identify any transactions with missing supporting documents.

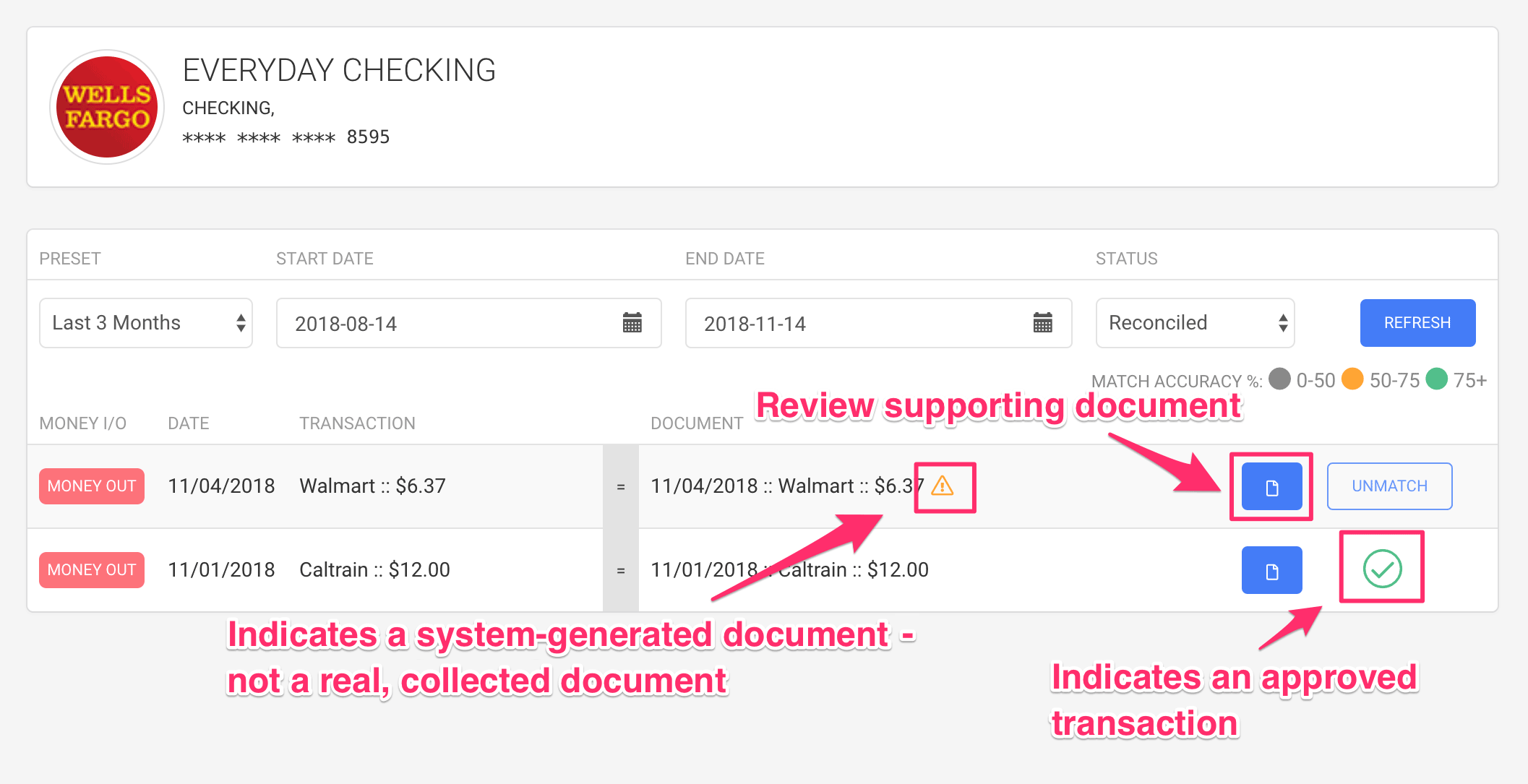

- Filter the transactions by “Reconciled” status to review all matched transactions.

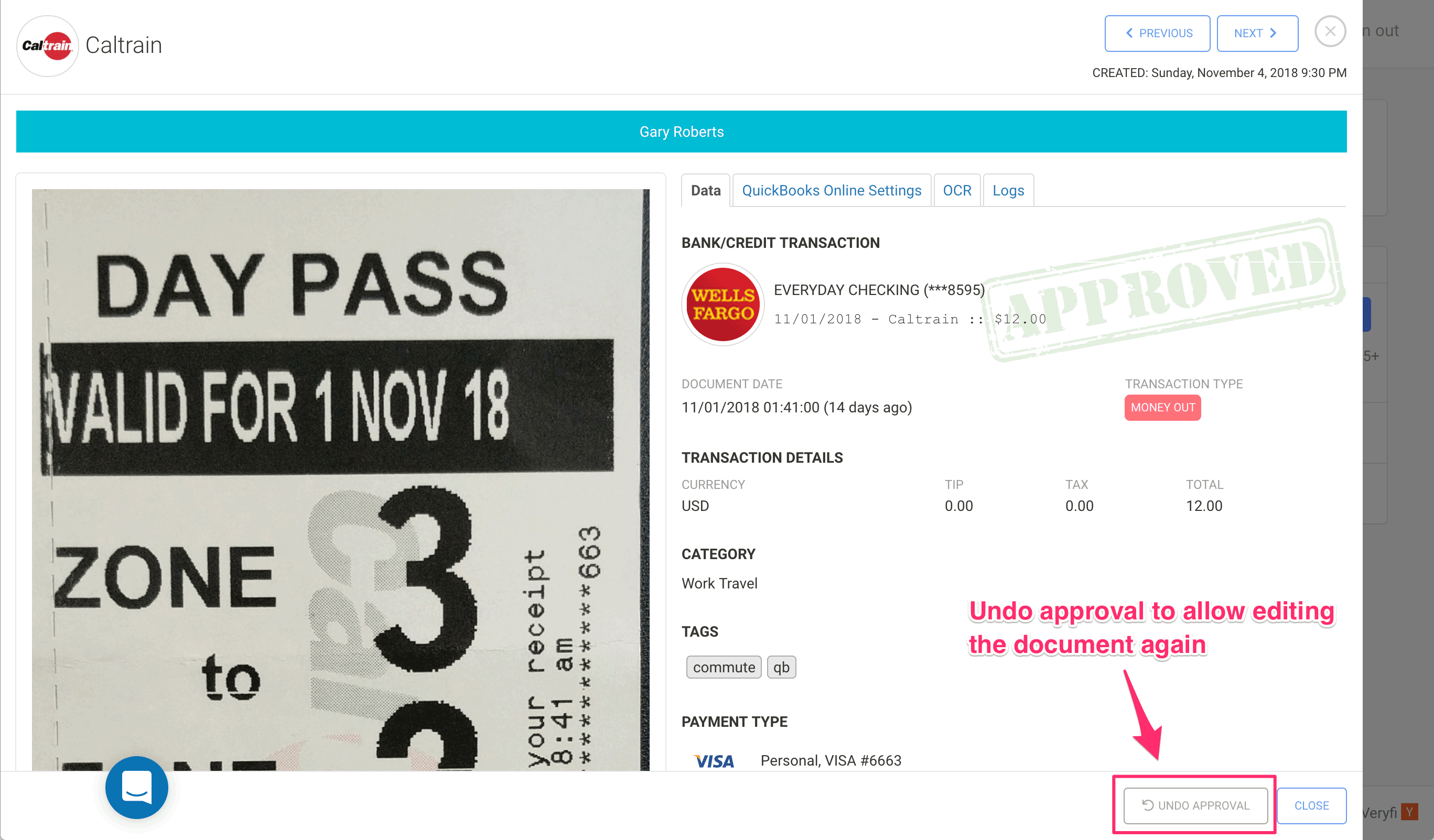

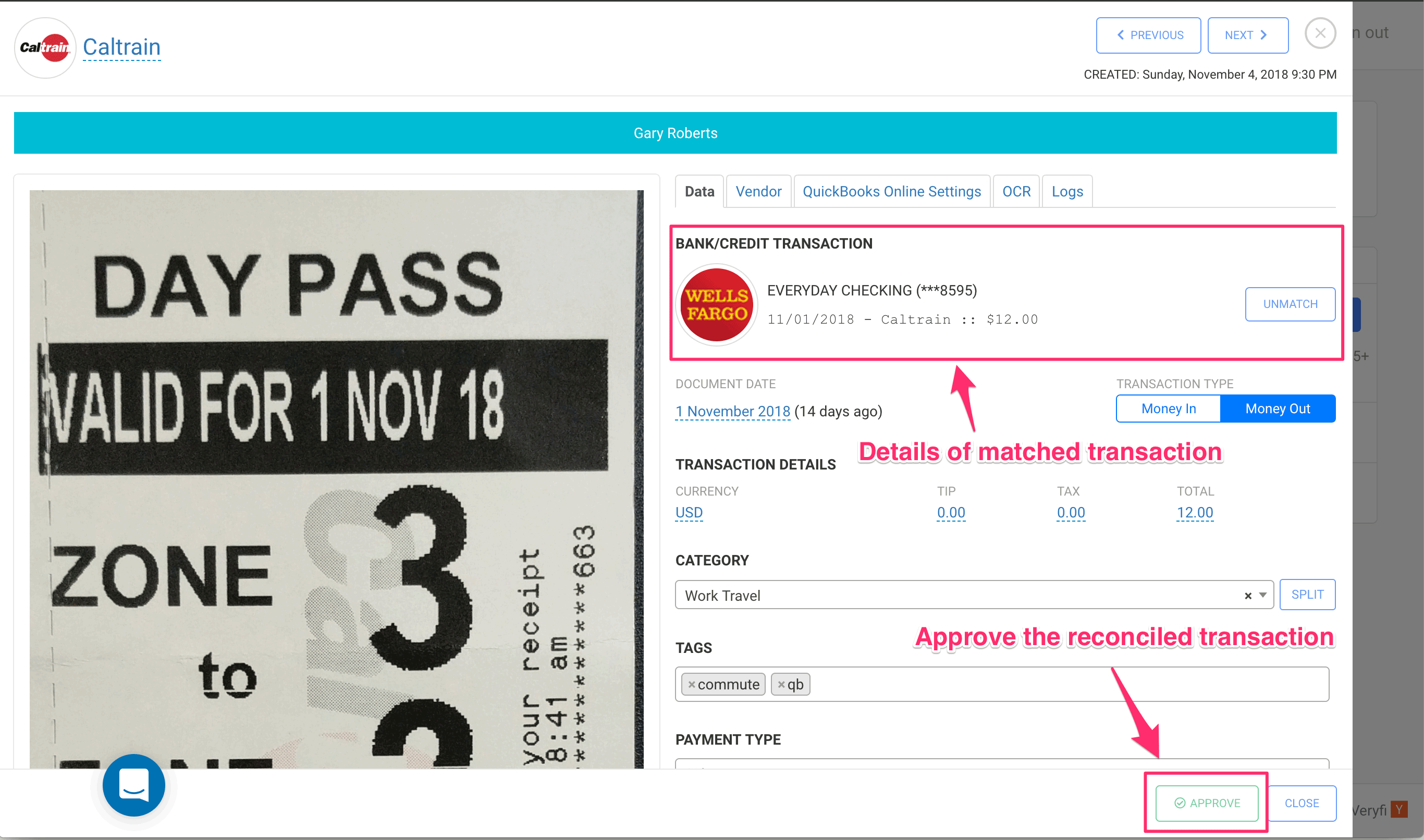

- Click on the document preview button to review the supporting document. At this point you have the option to “unmatch” a transaction from a document if it isn’t valid/acceptable, or approve it if it is.

- Once a reconciled expense is approved, it is no longer editable. Of course, if changes need to be made, they can be. To unlock the document, the approval first needs to be reverted.