A bank reconciliation is the process of matching the balances in an entity’s accounting records for a cash account to the corresponding information on a bank statement. The goal of this process is to ascertain the differences between the two, and to book changes to the accounting records as appropriate.*

Why reconcile bank transactions

Assuming you have activity in your bank account, connecting and verifying transactions on a periodic basis will help to:

(a) ensure that your company’s cash records are correct,

(b) identify low cash balances (especially if your business runs on accrural accounting),

(c) find bounced checks or overdraft fees and

(d) detect some types of fraud (eg. highlight any ACH debits from the account that you did not authorize

How often should you run bank reconciliation?

Daily.

However, Monthly is also ok and often the old practice using old-school tools. In Veryfi, you can do this Daily and with automation that removes the burden and friction of individual manual labor.

Let’s get started!

Step by step: Connect a bank or credit card account

1. Login to hub (web portal): https://hub.veryfi.com/

2. Once logged in, open My Toolbox in the left menu and select Banking.

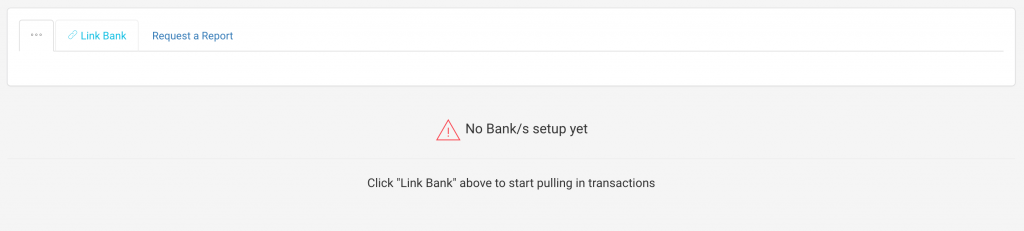

3. Select the Link Bank tab

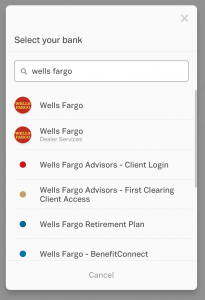

4. Start typing your bank/credit provider’s name, then select the appropriate option when it appears

5. Follow the on-screen prompts to finish setting up the account.

IMPORTANT NOTE: It may take up to 48 hours for your transactions to appear after the initial account set up. This is because the initial transaction download happens in 3rd party systems who provide transaction data to Veryfi. Typically the wait time is within 24 hours.

Step by step: Bank Reconciliation

1. Login to hub (web portal): https://hub.veryfi.com/

2. Once logged in, open My Toolbox in the left menu and select Banking.

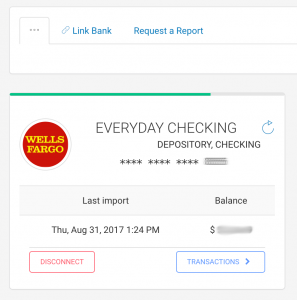

3. Click the Transactions button on the account you want to reconcile

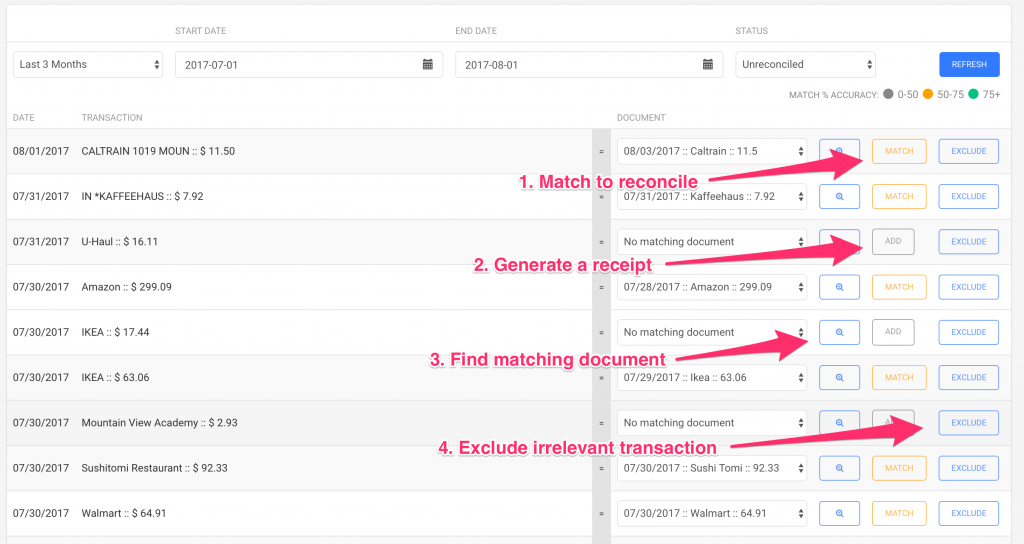

4. Select the appropriate date filters you’re interested in. Also, choose between Reconciled, Unreconciled and Excluded transactions

5. Reconcile transactions using the buttons on the right of each transaction:

6. To reconcile correctly matched transactions, click the Match button.

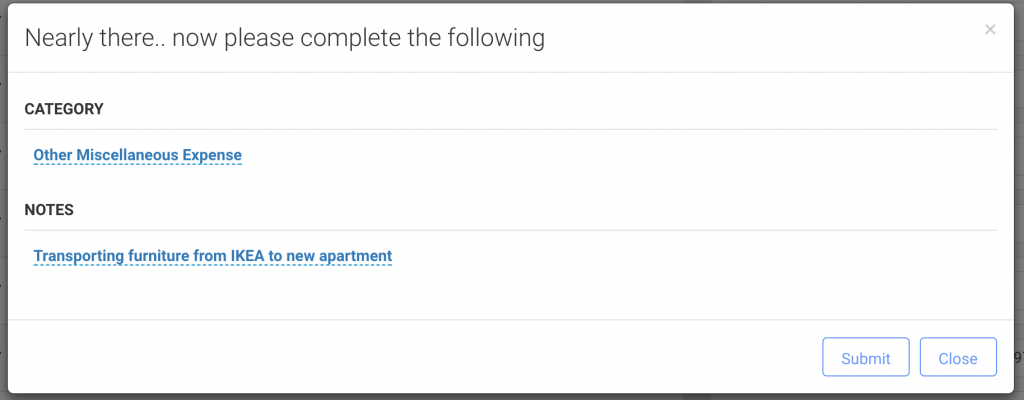

7. When a receipt isn’t available for a transaction, Veryfi can generate one for you. In the US, this would typically be used for transactions under $75 as the IRS doesn’t require vendor receipts for those expenses. To generate such an invoice, click the Add button, then select a Category and optionally enter Notes

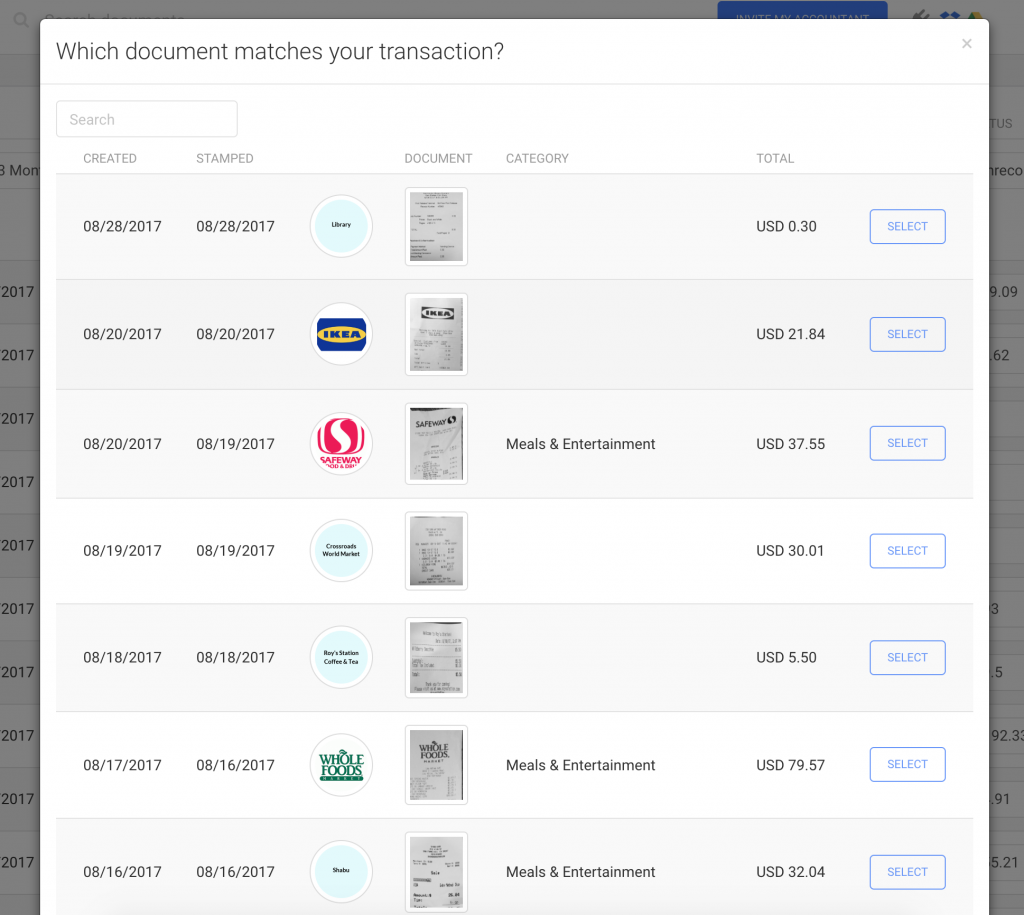

8. Where a receipt is not found but is available, click the search button to manually select the appropriate document

9. For transactions that don’t have relevance, such as transfers between accounts (from checking account to savings, for instance), click the Exclude button.

And that’s it. Bank Reconciliation done.

5 min demo video of reconciliation

If you have questions or want a demo please reach out to us.

FAQ

Q: How many banks do connect to in the US?

A: A full list of institutions is provided here https://www.veryfi.com/howto/banks-support/

Q: Who provides your backend bank connection?

A: Envestnet | Yodlee. Same company used by Xero and 90% of accounting products in the US. Yodlee is the leader in providing bank feed data in the US.

Q: Do you store my logins / passwords?

A: No. We only store a session key assigned to your account by Envestnet | Yodlee. This means your login credentials are super safe. Please make sure you enable 2 way-auth authentication to instil a good security practice.

Q: Where else can I learn more about Veryfi’s Bank Feeds?

A. On the Veryfi Bank Feed FAQ Page.