Every country in the world has their own jurisdiction on sales taxes. For example; Goods and Services Tax (GST) sales tax is common among all Commonwealth countries like Australia, New Zealand and Canada.

In Canada, it’s a bit more complex and in excess of the federal with respect to the provinces there are:

- GST/HST (Harmonized Sales Tax) which may vary by province.

- PST (Provincial Sales Tax)

- QST (Quebec Sales Tax) *Used only in Quebec

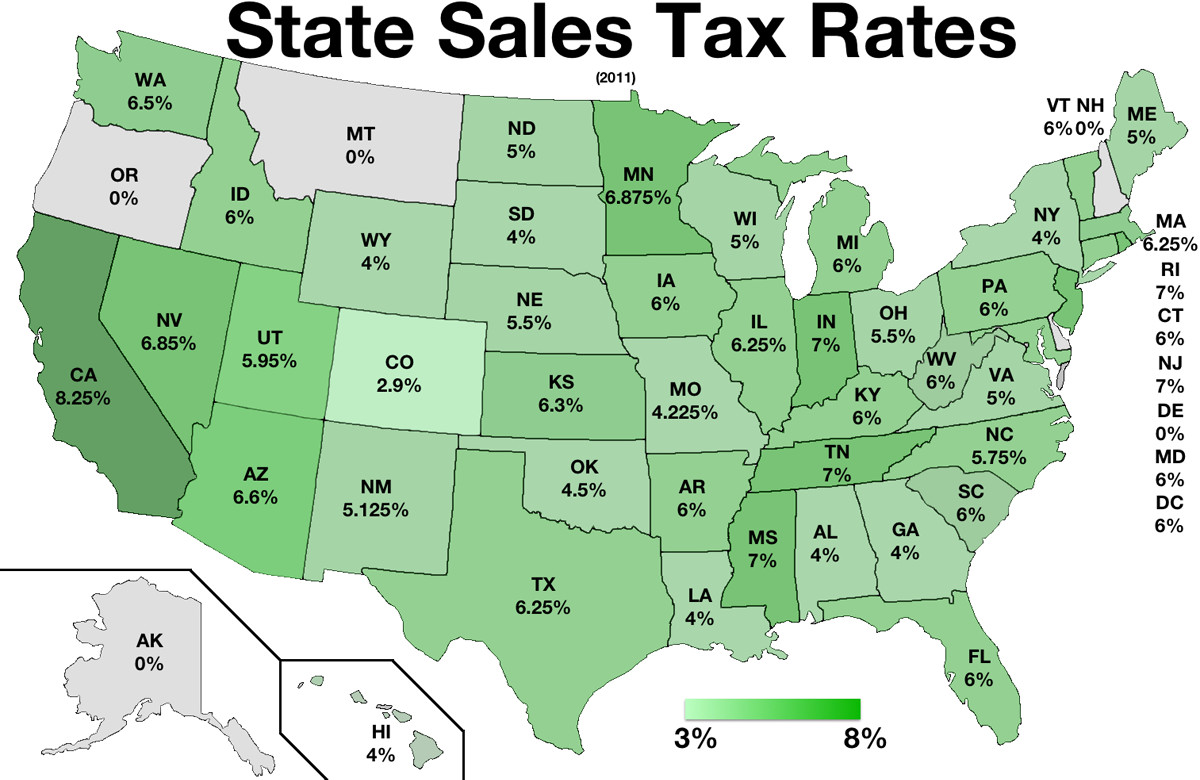

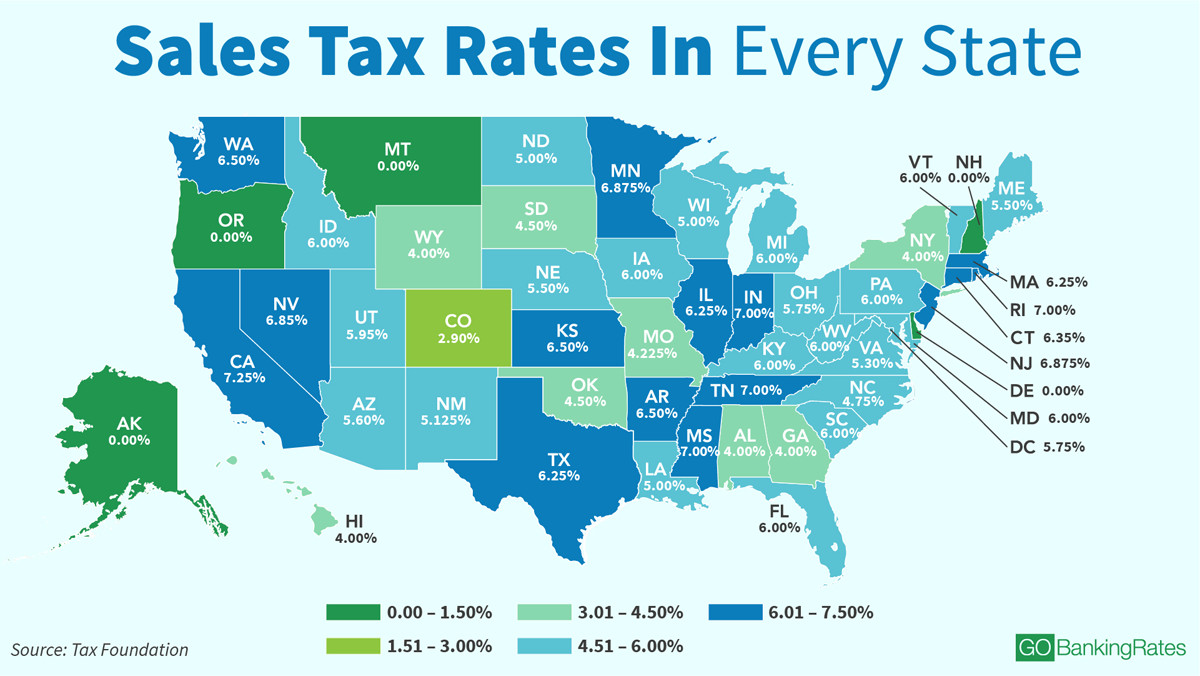

While in the US it looks something like this across all the states:

Tracking and reporting on taxes is important for all business entities to comply with local tax laws. This is why Veryfi supports tracking and extracting up to 3 sales taxes on each of your transactions.

Veryfi can track up to 3 sales taxes per transaction

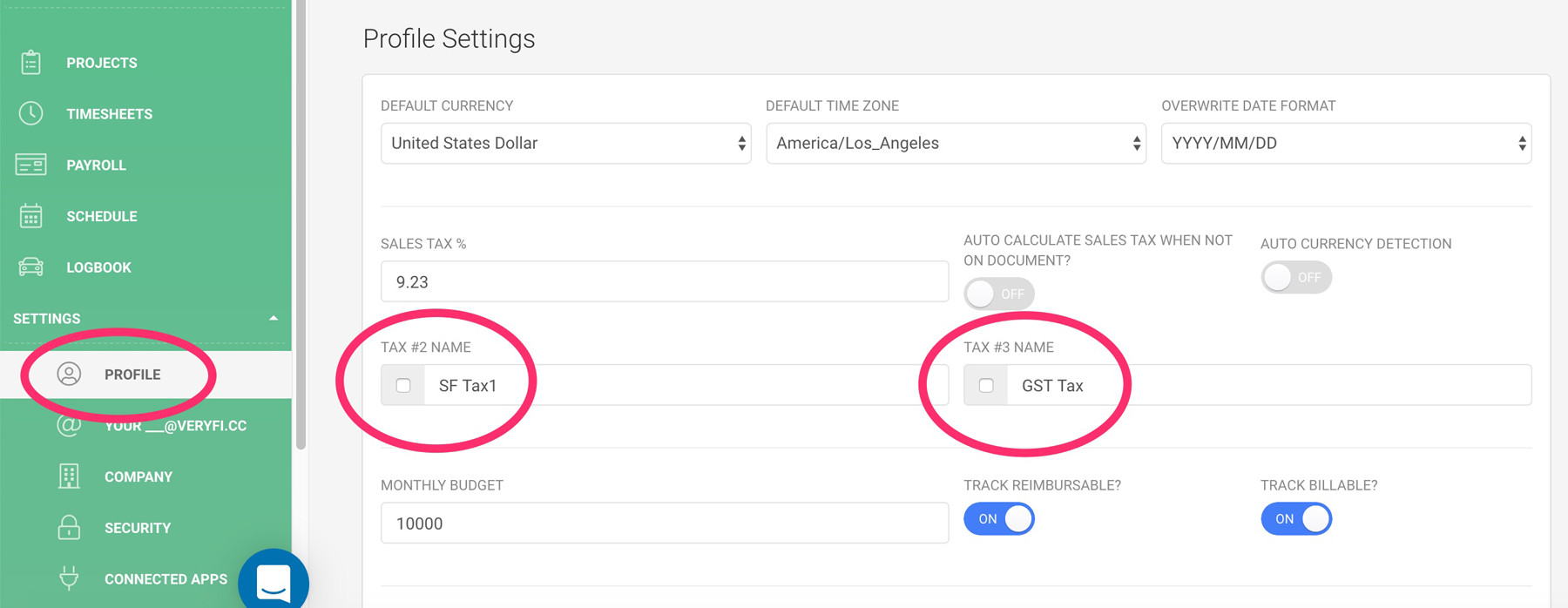

By default (and to remove interface complexity) Veryfi is enabled to track just the 1 sales tax.

However, at any time you can enable an additional one or 2 in seconds within your Veryfi Profile page here.

- Go here: https://hub.veryfi.com/me/?type=profile

- Look for Tax #2 and Tax #3 as show below and 1st press the checkbox to enable it then give it a label. Label defaults are already in place (as shown below) but you can overwrite them anytime.

Let us know how this works out for you.

To learn more about the different tax rates, then visit this EY 2018 Worldwide VAT, GST and Sales Tax Guide: https://www.ey.com/gl/en/services/tax/worldwide-vat–gst-and-sales-tax-guide—rates