Owning a property as an investment can be lucrative, but it can also come with a lot of financial management hassles.

About 15 years ago I was doing my 1st property renovation ever. That’s me in the blue shirt.

Back then I knew very little about financial management of my assets. I used spreadsheets & a shoebox to keep track of all my money out. Time and experience taught me the rest.

And today I want to share with you what I have learnt and also built for property investors like us.

You are running a business

Investment property/ies are vehicles to building wealth. Tax laws exist to help you make the most of these investment vehicles. Therefore you need to treat this like you would a business. The product is your property.

Like a business, you also need to spend money to make money. Therefore your wealth strategy should not only focus on income but also the tax advantages you get from claiming deductibles against your taxable income.

Let me show you what I’m talking about.

I’ve been a landlord for over 15 years, and I can’t tell you how many times I’ve asked myself:

- What is my net rent? Am I making money or losing money?

- Is this investment property a good investment?

- Are there any red flags (unallocated expenses) eating away at my net rent?

- Is my property negatively geared (deductible expenses exceed income)?

- Where is my money actually going?

This uncertainty was one of the reasons I created the Veryfi software suite for landlords like you and I.

Today, I’m better equipped with the tools and processes necessary to track what I’m spending on my investment property and what I’m putting in my bank account. I no longer burn valuable time shuffling a shoebox full of receipts or paper notes. No more weekends buried in a spreadsheet. No more sore eyes from poring over logs of property transactions as burden of proof for the taxman.

Now everything happens in real-time, and it’s easier to catch red flags before tax time. All I have to do is feed the app with data and I’m given a whole new world of insight into my expenses and income.

What a landlord needs to know to minimize taxes

You’ll have a much easier time with taxes on your short-term vacation or rental property if you treat it as a business from the get-go and keep meticulous records. Here are the basics:

- Money Out – Expenses (receipts, bills, et al.)

You are entitled to deduct all “ordinary and necessary” expenses to operate your rental business. If you buy new towels for your guests, repaint the guest-room or put a bottle of wine on the table for incoming guests, you can deduct these expenses from your rental income.

By keeping clear records and recording all money you spend on the property (your business), you won’t have to go back through bank statements for proof when filing taxes. - Money In – Income

- Vehicle use related to your property

The industry term for all this is bookkeeping. It’s usually boring and time-consuming, but it doesn’t have to be that way.

How I use Veryfi

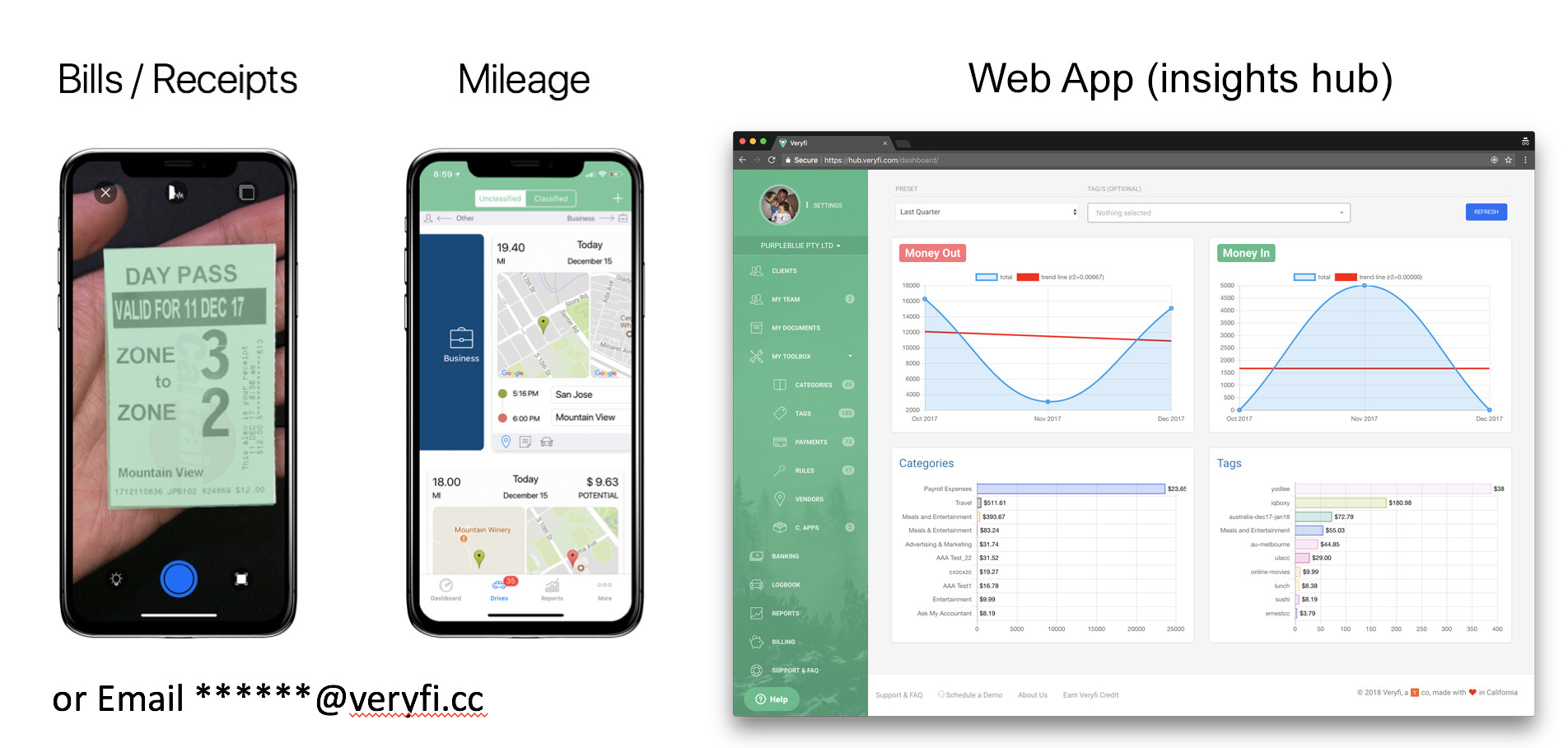

Veryfi is a suite of bookkeeping apps that are 100% powered by machines, end-to-end. No humans ever see your sensitive personal and financial information.

Collecting receipts for all my expenses

Veryfi app helps me collect all expenses and income. All you need to do is capture those documents by either taking a picture, emailing to your unique Veryfi email, using cloud storage to push documents to Veryfi.

Deductibles you need to retain receipts of;

- You’ll find a ton of expenses related to your rental investment that can be claimed as deductibles come tax time. Just make sure you have receipts for proof — another reason to use a flawless bookkeeping process like Veryfi.

- Advertising your property for rent

- Cleaning and maintenance services, including laundry and cleaning supplies purchased

- Utilities like gas, electricity, TV, internet, garbage collection, etc.

- Property insurance, in addition to building and content coverage

- Council bills (usually quarterly in Australia)

- Acquisition and disposal costs, including the purchase cost, conveyancing and advertising costs and stamp duty

- The cost of managing the property (i.e., legal fees and accountancy fees incurred by the host in connection with renting the property)

- Strata / homeowners’ association (HOA) fees

- Cleaning bills

- Repairs, i.e. fixing broken windows, doors, furniture and machines, etc.

- Property management costs

- Registration fees for relevant conferences or education on property management

- The cost of your Veryfi PRIME subscription

All these deductibles help reduce your taxable income. Like I said earlier, your wealth strategy should not only focus on income. It should include the claimed losses that would have reduced your taxes and put more money in your pocket.

Losing a receipt is like losing money.

The Veryfi Android app was recently featured as the best top 20 Android apps in 2018. Check out how simple it is to collect receipts using the Veryfi mobile app. The same experience is also available on the iOS.

Logging my business vehicle trips

Whenever I drive my personal vehicle for:

- Property inspections,

- Research new investment opportunities,

- Hardware shops for renovations or fixes I need to do at my investment properties, etc..

I always use this trusty Veryfi Logbook app to track my drives. All my business-related travels are automatically tracked and recorded, hands-free of course. I now save on average of $10,800 a year on my taxes and can reinvest that money back into my real estate portfolio.

This is the simplest app you will ever use. Once installed & setup you forget about it. When you drive it will automatically pick up the drive and after the drive is done, Veryfi logbook app will send you an alert to categorize the drive. That’s it.

Finally, I invite my Accountant into my Veryfi account

To empower them with all my asset financials. This way no more sending or faxing paper documents at the end of the year when its tax time.

Now my accountant can;

(a) See all my investment property documents (receipts, invoices, bills et al) in real-time 24/7 through the web app (hub),

(b) Be able to contact me using in app cloud messaging and SMS,

(c) Run reports on my assets to gain insights of cash flow, deductibles etc and

(d) Provide me regular advice on how to optimize my investments.

In Summary

The tools I presented here all integrate together.

So there is no need to do any API connections, learn new interfaces or have multiple logins. One login gets you into the 2 mentioned apps (Veryfi Core and Veryfi Logbook) and also into the Web App which is a unified Hub of all those services in a desktop experience for larger screens.

Have questions?

If you have further questions please reach out to me directly on [email protected].

NOTE: Tax advice is complicated, and you should do your own due diligence when receiving advice. Veryfi is not responsible for any tax or other advice provided by any outside entity.

~ Ernest Semerda

Veryfi Cofounder